Vision

To be a trusted and accessible financing company that supports Indonesia's economic growth

PT Sinar Mitra Sepadan Finance developed its Vision, Values, and CVP based on the ORIX Group Purpose & Culture

Value

Collaboration: Working closely with different individuals and teams, leveraging diverse knowledge to achieve common goals.

Honesty: Commitment to be honest, transparent, and sincere in dealing with others.

Open Minded: A flexible and adaptive mindset to new ideas, perspectives, and approaches.

Integrity: Uphold strong moral and ethical standards as a guide for individual and organizational behavior.

Customer Centrix: Prioritizing solutions to fulfil customers’ needs and satisfaction for external and internal customers.

Excellence: Commitment to achieve the best performance and set the highest standards in all activities.

PT Sinar Mitra Sepadan Finance developed its Vision, Values, and CVP based on the Orix Group Purpose & Culture

About ORIX

ORIX Group is a global group of companies operating in various sectors, including financing and investment, life insurance, banking, asset management, real estate, concessions, environment and energy, automotive services, industrial equipment/ICT, ships and aircraft.

We unite globally with our Purpose: "Finding Paths. Making Impact", bringing together diverse expertise and innovative thinking to support sustainable world development.

For more information about ORIX and its financial services, visit our website at www.orix.co.jp.

Company Profile

PT Sinar Mitra Sepadan Finance (“Company”) is a national finance company founded on 28 November 2000. The Company obtained a business license through Decree of the Ministry of Finance Number 365/KMK.06/2001 on 11 June 2001. Currently, the Company is domiciled in Jakarta South with head office at Agro Plaza Floors 16-17, Jl. H.R. Rasuna Said Kav. X2-1, Kuningan Timur, Setiabudi, South Jakarta 12950.

The Company's current shareholders are ORIX Corporation from Japan and PT Sinar Mas Multiartha, Tbk. (“SMMA”), with ORIX Corporation as the majority shareholder of 85%.

The company has become part of ORIX Corporation, Japan, which has a network in more than 30 countries and is listed on the New York Stock Exchange. PT Sinar Mitra Sepadan Finance operates in the field of financing services for motorized vehicles with four or more wheels. For more than 20 years, the Company has grown to have more than 100 networks (Branch Offices and Offices Other Than Branch Offices) throughout Indonesia and more than 2,000 employees.

SMS Finance, the financing company of choice for used and multi-purpose cars with car BPKB guarantee, low interest starting from 0.7%!

Code of Conduct & Ethics

The Code of Conduct is SMS Finance's commitment to comply with legal provisions, regulations and ethical standards in every operational activity. This guideline is not only a guide for the company, but also for all SMS Finance employees.

These guidelines also set out how SMS Finance employees should behave as representatives of the company, as well as their responsibilities towards the company, potential debtors or debtors, business partners, the government and other stakeholders. This Code of Conduct will help SMS Finance employees act in accordance with the business and ethical standards set by the company.

The Code of Conduct that we apply includes the following:

1. Integrity at Work

-

- Behave Honestly

- Discipline and Responsibility

- Comply with Legal Regulations

- Avoiding Conflicts of Interest

- Prohibition of Insider Trading (Insider Trading)

- Mature Consideration in Giving or Receiving Gifts, Meals and Donations

- Anti-Fraud

- Anti-Money Laundering, Terrorism Financing & Funding for the Proliferation of Weapons of Mass Destruction

2. Professionalism

-

- Self-development

- Communication Ethics

- Prevent Discrimination, Harassment and Deviant Behavior

- Not Involved in Political Activities

- Not Involved in Prohibited Organizations and/or Violating the Law and/or Potentially Harmful and Disrupting Business Activities

- Creating Healthy Competition

- Intellectual Property Rights

3. Commitment to Prospective Debtors and Debtors

4. Commitment to Other Stakeholders

-

- Commitment to Shareholders

- Commitment to Business Partners

- Commitment to the Government as Regulator

- Commitment to Community

- Commitment to Environment, Health and Safety

5. Asset Protection, Data Confidentiality and Transparency

-

- Protecting Company Assets and Reputation

- Maintaining the Confidentiality of Company Data and/or Business Information

- Accounting and Financial Reporting

- Reporting Violations and Fraud

- Document Management

Privacy Policy

Welcome to the website of PT Sinar Mitra Sepadan Finance (hereinafter referred to as "SMS FINANCE" or "We"). This page displays the General Terms and Conditions of Privacy Policy for our services. By registering yourself on our site, it means that you, as a service user (User) agree to the General Terms and Conditions of the Privacy Policy below. By becoming a User, you agree to the collection, use, sharing of your Personal Data information, and agree to the terms of this Privacy Policy.

We are committed to protecting and maintaining the confidentiality of your Personal Data in accordance with applicable laws and regulations. In its implementation, what is meant by "Personal Data" is data about an individual who is identified or can be identified separately or in combination with other information either directly or indirectly through electronic or non-electronic systems. We guarantee that we will not collect, use, disclose, transfer, store and process Personal Data including Your credentials to third parties, either commercially or non-commercially, for purposes other than as specified in this Privacy Policy. We guarantee that We will process Your Personal Data professionally and responsibly and the results of such processing are sourced only from original and accurate Personal Data information as contained in Your account.

-

INTRODUCTION

-

Purpose of Privacy Policy

This Privacy Policy describes the types of Personal Data that We collect and how We collect, use, disclose, transfer, process, store and protect such Personal Data. -

Applicability of Privacy Policy

This Privacy Policy applies to online services offered by SMS FINANCE on Our website and mobile sites that refer or link to this Privacy Policy. -

Scope of Privacy Policy

This Privacy Policy covers information collected through online services and direct communication between You and SMS FINANCE. This Privacy Policy does not cover information contained on other websites and applications, unless specifically stated. This Privacy Policy also does not cover information when you call us, send us a message, or communicate directly in any way other than through our website and mobile site services. The following are some of SMS Finance's official websites whose use is subject to this privacy policy.- www.smsfinance.co.id and its derivatives:

- Mobile Application namely, SMS Finance & SMS Finance Agent

-

-

PERSONAL DATA WE OBTAIN AND COLLECT FROM YOU

- The personal information/data that we obtain from you depends on the type of products and services that you apply to us. In the process of job application and/or financing application, including but not limited to full name, gender, type of identity card, identity card number, address in accordance with the identity card, province and city/district, telephone and mobile phone numbers, email address, your occupation, your ID card, spouse's ID card, family card, and NPWP. We will also ask for your vehicle data that will be used as collateral if your financing application is a loan, including but not limited to information on vehicle brand, vehicle type, vehicle model, vehicle year, and BPKB in whose name. The types of information/personal data mentioned, including but not limited to other additional information/data that we may ask for in the future.

-

Site Policy

We may collect information about several things when you use Our service site. We and Our service providers (such as third party content, advertising and analytics providers) automatically collect certain information from Your device or web browser. For example, every time You visit Our service site, We together with Our third party service providers automatically collect things such as Your IP address, mobile device identifiers or other types of unique identifiers, browser and computer types, access times, the web page You came from, the URL where You landed, and the web page You accessed as well as Your interaction with content or advertisements on Our service. When You use or interact with Our services, this can help Us understand how Our Users use Our services.-

Third Party Analytics Services

This website uses Third Party Analytics Services, including but not limited to Google Analytics to analyze access statistics and make improvements to the website. Google Analytics uses cookies by collecting user data but does not include personally identifiable information. Please note that Google Analytics has a different privacy policy and practices, which you can find on their website.

- Advertising

- SMS Finance uses advertising services in connection with the SMS Finance website, including but not limited to Google and Meta Advertising. Google and Meta Advertising are third party advertising services that we use to display advertisements related to our products on various platforms that cooperate with Google and Meta Advertising. By using our site, you agree to follow this policy. Use of Cookies to provide relevant ads and improve user experience. We use cookie technology provided by Google and Meta Advertising. Cookies are small text files placed on your device when you visit Our site that collect anonymous information such as user preferences, browsing activity and demographic information. The information collected by cookies is used to display advertisements that match your interests and preferences.

-

Use of Data

Google and Meta Advertising use data collected through cookies to display relevant advertisements on third-party sites that cooperate with Google and Meta Advertising. The data does not contain personal information that can directly identify you. The data used includes information about user preferences, browsing activity, and general demographic information. -

Opt-Out

If you do not wish to receive advertisements served by Google and Meta Advertising, you may opt-out of the use of cookies by setting your advertising preferences through your Google account settings or through other settings provided by Our services. However, please note that even if you opt out of the use of cookies, advertisements may still be displayed, but will not be tailored to your interests and preferences. -

Data Sharing

We do not share users' personal information with Google or Meta Advertising. Information collected through cookies is used anonymously and only for advertising purposes. -

Data Security

We keep user data secure by implementing appropriate security measures to prevent unauthorized access, unauthorized use, or unauthorized alteration of user data. Please note that Google and Meta Advertising have different privacy policies and practices, which you can find on their websites.

-

-

PRIVACY POLICY APPROVAL

- We do not collect, use, disclose, transfer, process, store and protect Your Personal Data without Your express consent (except where permitted and authorized by law). By agreeing to this Privacy Policy, as well as entering Your credentials (username and password) on the platform that We have specified, You hereby expressly consent to Us to collect, use, disclose, transfer, store, and process any Personal Data information including Your credentials that are relevant and necessary to carry out the purpose of using the online services of SMS Finance that You use, including but not limited to the financing application process, assistance and complaint services, employee recruitment process, and others. The consent you provide includes but is not limited to:

-

Consent to be contacted by SMS Finance to follow up on the online service request that You submit through Our website and mobile site.

- Consent to receive information about SMS Finance products/programs that are being proposed through Short Message Service (SMS), Telephone and/or other media.

-

Approval of the data and/or information verification process of prospective debtors/consumers/partners/employees required before the decision of approval/rejection of financing/cooperation/recruitment is given and will be carried out in various ways including but not limited to checking the OJK Financial Information Service System (SLIK), credit bureau and/or by issuing digital or electronic certificates. The consent you give does not include to make changes in any form to your credentials and Personal Data.

-

-

In addition, We and Our affiliates and other service providers in Indonesia may disclose Your Personal Data where We are required upon lawful request to do so by law i.e. to law enforcement agencies or other government officials.

-

We will take reasonable steps to ensure that Your Personal Data is handled in accordance with this Privacy Policy, regardless of where Your Personal Data is stored or accessed.

-

You will defend, release from liability and hold Us harmless from any and all third party claims, and Our judgments, losses, payments, costs, expenses (including those related to investigations or reasonable attorneys' fees), damages, settlements, liabilities, fines or penalties actually decided or settled in court, arising out of or related to third party claims (a) arising out of a breach by You; or (b) arising out of any breach by You of the terms and conditions of any other account in the online ecosystem used by You for the purpose of verification of Your Personal Data; or (c) arising out of any infringement or misappropriation, by You of any patent, or copyright, or trade secret rights of a third party under the applicable laws of any jurisdiction.

-

By providing your consent to this Privacy Policy, you represent that you have reached the legal age of consent in your jurisdiction and have full authority to consent.

- We do not collect, use, disclose, transfer, process, store and protect Your Personal Data without Your express consent (except where permitted and authorized by law). By agreeing to this Privacy Policy, as well as entering Your credentials (username and password) on the platform that We have specified, You hereby expressly consent to Us to collect, use, disclose, transfer, store, and process any Personal Data information including Your credentials that are relevant and necessary to carry out the purpose of using the online services of SMS Finance that You use, including but not limited to the financing application process, assistance and complaint services, employee recruitment process, and others. The consent you provide includes but is not limited to:

-

SAFETY & PROTECTION

-

implement strict procedures, standards and security arrangements to protect Your credentials and Personal Data that are in Our possession or under Our control. Upon receipt of Your credentials and Personal Data, We will make necessary security arrangements to protect Your credentials and Personal Data with Our best efforts and in accordance with the situation. Such arrangements may consist of administrative measures, physical measures, technical measures, or a combination of such measures.

-

When disclosing or transferring Your Personal Data over the internet, We will take all precautions in Our best efforts to prevent unauthorized access to Your Personal Data. However, no data transmission over the internet can be guaranteed to be completely secure and You acknowledge that You convey information over the internet at Your own risk.

-

-

APPLICABLE LAW

This Privacy Policy is governed by Indonesian Law.

-

CONTACT US

If you have any questions or comments about this Privacy Policy, or if you would like to ask us to update the information we have about you or your preferences, please contact us by email at customer.care@smsfinance.co.id or by phone at 1500-403.

Reporting

Laporan Keberlanjutan PT Sinar Mitra Sepadan Finance Tahun 2024

Laporan Keberlanjutan PT Sinar Mitra Sepadan Finance Tahun 2023

Laporan Keberlanjutan PT Sinar Mitra Sepadan Finance Tahun 2022

Laporan Keberlanjutan PT Sinar Mitra Sepadan Finance Tahun 2021

Laporan Keberlanjutan PT Sinar Mitra Sepadan Finance Tahun 2020

Publikasi Penanganan Pengaduan 2020

Publikasi Penanganan Pengaduan 2021

Publikasi Penanganan Pengaduan 2022

Publikasi Penanganan Pengaduan 2023

Publikasi Penanganan Pengaduan 2024

Official Social Media Account of SMS Finance

SMS Finance Social Media

Get closer to SMS Finance

Get information about our product and service promo programs on Instagram @smsfinanceid Please Visit >

Get the latest career and training information at SMS Finance Please Visit >

Facebook

Get closer to SMS Finance, get information about the program.

Promo our products and services on Instagram @smsfinanceid Please Visit >

Management Profile

COMMISSIONERS STRUCTURE |

|

Yoshiaki Matsuoka |

President Commissioners |

|

|

Japanese citizen, born in 1968. He obtained his Bachelor of Science degree from Kwansei Gakuin University in 1991. He started his career at ORIX Corporation since 1991 and has more than 30 years of experience in the financial industry, with placements in various ORIX Corporation Group companies around the world. He has served as President Commissioner of SMS Finance since April 2022 until now.

|

|

|

Takehiro Onishi |

Commissioners |

|

|

Japanese citizen, born in 1979. He obtained his Bachelor of Commerce degree from Waseda University in 2002. He started his career at ORIX Corporation since 2002 and has more than 20 years of experience in the financial industry, with placements in various ORIX Corporation Group companies around the world. In 2015, he was appointed as the Director of SMS Finance, and since February 2021, he has served as the Commissioner of SMS Finance until now. |

|

|

Mahendra Wardhana |

Independent Commissioner |

|

|

Indonesian citizen, born in 1959. He earned a Bachelor of Science in Electrical Engineering in 1984 from Syracuse University, USA and a Master of Business Administration in Corporate Finance from the University of Southern California in 1987. He started his career in 1987 and has more than 30 years of experience in the financial industry in Indonesia, including the banking and financing industry. He has served as Independent Commissioner of SMS Finance since May 2016 until now. |

|

|

Lukman Boenjamin |

Independent Commissioner |

|

|

Indonesian citizen, born in 1954. He obtained his Bachelor of Economy from Faculty of Economy, University of Indonesia in 1981, and Master of Arts, Economic Development from Michigan State University in 1985. He started his career since 1981 and has more than 40 years of experience in the financial industry in Indonesia, especially in Bank Indonesia, as the regulator of banking sector; and multi-finance industry. He has served as Independent Commissioner of SMS Finance since February 2024 until now. |

DIRECTORATE STRUCTURE |

|

|

Hidenori Kuwahara |

President Director |

|

|

Japanese citizen, born in 1975. He obtained his Bachelor’s degree from the Faculty of Commerce, at Doshisha University in 1998. He started his career at ORIX Corporation since 1998 and has more than 20 years of experience in the financial industry, with placements in various ORIX Corporation Group companies around the world. He has served as President Director of SMS Finance since February 2022 until now. |

|

|

Rully Mieke Octaviana |

Vice President Director |

|

|

Indonesian citizen, born in 1981. She obtained her Bachelor degree of Environmental Engineering from Sepuluh November Institute of Technology in 2003. She had experience in financing industry for more than 20 years. She started her carreer in SMS Finance as Credit Iniation Manager (2011-2015), Senior Manager Marketing Analysis & Strategy (2016), Deputy General Manager Marketing Analysis & Strategy (2016-2017), General Manager Risk Management (2017-2018). In March 2018, she was appointed as Director of SMS Finance and since July 2022, she has been appointed as Vice President Director of SMS Finance until now |

|

|

Yukio Minagawa |

Director |

|

|

Japanese citizen, born in 1977. He obtained his Bachelor of Economics degree from Chuo University in 2002. He started his career at ORIX Corporation since 2006 and has approximately 20 years of experience in ORIX Corporation Group. He has served as Director of SMS Finance since October 2019 until now |

|

|

Robert Haries Cokrowinoto |

Director |

|

|

Indonesian citizen, born in 1984. He obtained his Bachelor degree in Economics from Widya Mandala Catholic University Surabaya in 2008. He has experience in financing industry for more than 15 years. He started his career at PT Sinar Mitra Sepadan Finance as Area Manager for East Java Area (2016-2018), and General Manager Sales & Business Division & Task Force Division (2018-2021). Since April 2021, he has been appointed as Director of SMS Finance until now. |

SHARIA SUPERVISORY BOARD STRUCTURE |

|

|

Asrori S Karni |

Chairman of SSB |

|

|

Indonesian citizen. Obtained his Bachelor's degree from Sharia Faculty of Syarif Hidayatullah State Islamic Institute Jakarta in 1998 and Master of Law degree from University of Indonesia in 2007. He has experience as a lecturer at various leading universities in Indonesia such as Syarif Hidayatullah State Islamic University (UIN), Nahdlatul Ulama Islamic College, active in several Islamic organizations or institutions such as LBM NU and MUI, and has experience as a Sharia Supervisory Board in several finance companies including PT BFI Finance Indonesia, Tbk and PT Indomobil Finance Indonesia. He has served as Chairman of the Sharia Supervisory Board of SMS Finance since April 2021 until now |

|

|

AM Hasan Ali |

Member of SSB |

|

|

Indonesian citizen. Obtained his Bachelor's degree in Mu'amalah Program (Islamic Economics) from the State Islamic Institute of Syarif Hidayatullah in 1999 and his Master of Religion degree from Syarif Hidayatullah State Islamic University in 2003. He has experience as a lecturer at Syarif Hidayatullah State Islamic University (UIN), active in MUI, and has experience as the Remuneration and Nomination Committee at PT Bank Syariah BRI and Sharia Supervisory Board at PT Trihamas Finance Syariah. He has served as member of the Sharia Supervisory Board of SMS Finance since April 2021 until no |

REGIONAL MANAGER STRUCTURE |

|

|

Satiya Naden |

Regional Manager 2 |

|

|

Indonesian citizen, born in 1981. Obtained his Bachelor degree in Management from Atma Jaya University Yogyakarta (2007). He has been appointed as Regional Manager for Regional 2 of SMS Finance since March 2023. Regional 2 covers Banten Area, West Java Area, Jakarta Area, Central Java Area, East Java Area and East Java & Bali Nusa Tenggara Area. Before his career in SMS Finance He had served as Regional Manager for Nanggro Aceh Darusalam, North Sumatra & West Sumatra Area at PT Nusantara Cipta Dana Finance |

|

|

Rudy Pakan |

Regional Manager 3 |

|

|

Indonesian citizen, born in 1981. He obtained his Bachelor degree in Accounting Economics from Lambung Mangkurat University Banjarmasin (2005). He has been appointed as Regional Manager for Regional 3 of SMS Finance since July 2022. Regional 3 includes Kalimantan Area, East Indonesia Area 1, East Indonesia Area 2 & East Indonesia Area 3. Before his career in SMS Finance, he had served as Regional Manager for Kalimantan & Sulawesi Area at PT Nusa Surya Ciptadana (2018-2019). |

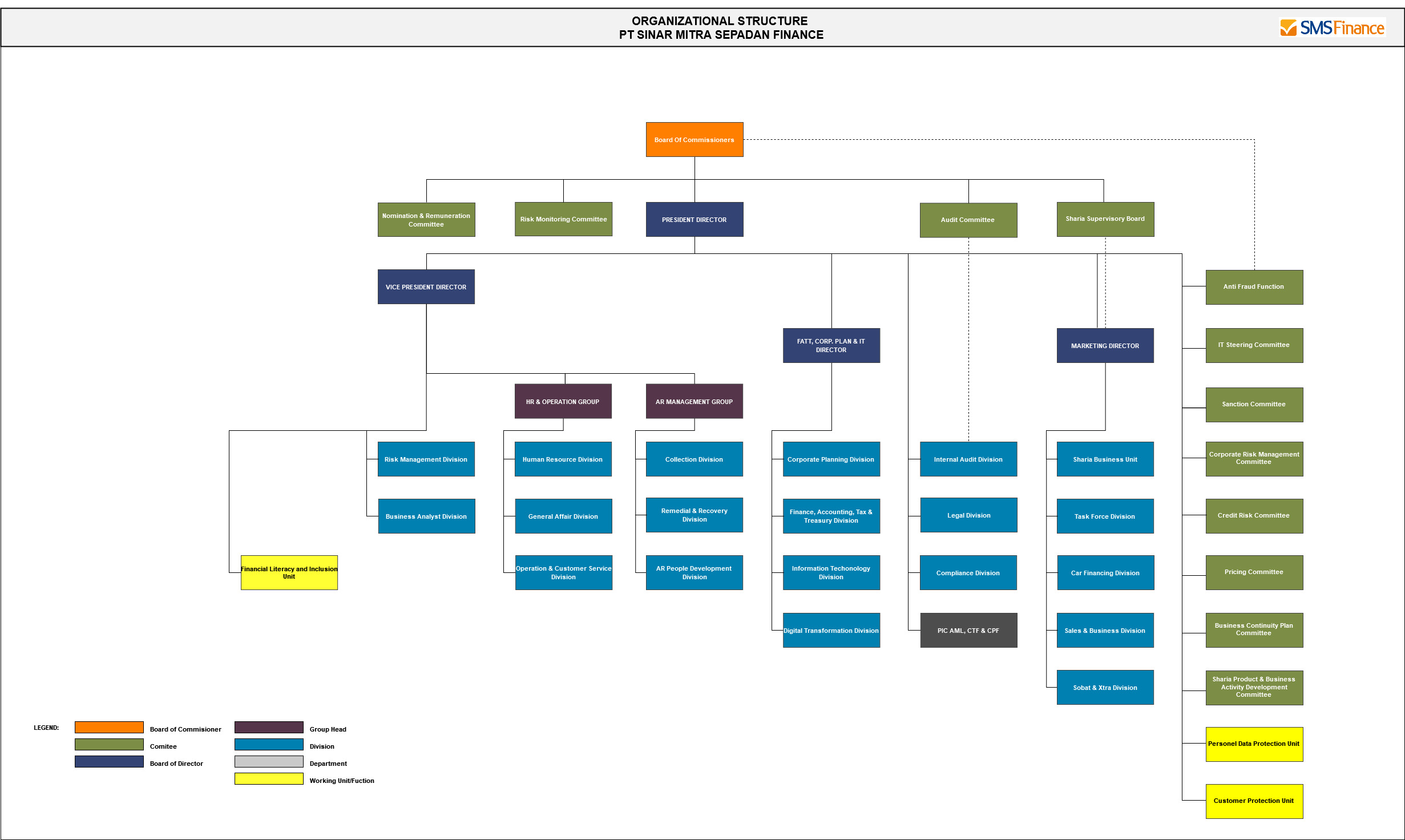

Organization Structure

Guidelines for Implementing Good Corporate Governance

Guidelines for Implementing Good Corporate Governance

SMS Finance implements the principles of Good Corporate Governance in all its business activities at all levels of the organization. These principles are as follows:

- Openness (Transparency)

SMS Finance is committed to implementing the principle of openness in the decision-making process, disclosing and providing relevant information regarding the Company.

- Accountability (Accountability)

SMS Finance guarantees clarity in the functions and implementation of responsibilities of Company Organs so that Company performance can run transparently, fairly, effectively and efficiently.

- Accountability (Responsibility)

SMS Finance is committed to ensuring compliance with the Company's management with laws and regulations in the field of financing and ethical values as well as standards, principles and practices for running a healthy financing business.

- Independence (Independence)

SMS Finance strives to apply professionalism in company management without any Conflict of Interest and influence or pressure from any party.

- Equality and Fairness (Fairness)

SMS Finance strives to maintain equality, balance and justice in fulfilling the rights of Stakeholders arising based on agreements, laws and regulations and ethical values as well as standards, principles and practices for implementing a healthy financing business

Guidelines for the Board of Directors, Board of Commissioners, and Sharia Supervisory Board

Duties and responsibilities of the Board of Directors, Board of Commissioners, and DPS

A. Duties and authorities of the Board of Directors of PT Sinar Mitra Sepadan Finance according to the Articles of Association of PT Sinar Mitra Sepadan Finance, are follows:

- The Board of Directors is fully responsible for conducting their duties for the interest of the Company in achieving its purposes and objectives;

- Every member of the Board of Directors is obliged to perform their duties with good faith and full responsibility by observing the prevailing laws and regulations;

- The President Director is entitled to represent the Company to governmental authorities, judicial institutions, public institutions and to other parties regarding all matters and at all events, to commit and bind with other parties and other parties with to the Company, and to take all actions, both related to management and ownership issues. In the event that President Director is unable to attend or is unable to represent the Company which does not need to be proven to a third party, it can be represented by 2 (two) Directors, of which at least one of them is a Director with foreign nationality; and

- The Director and all member of the Board of Directors are obliged to provide explanations on all matters asked by the Board of Commissioners.

B. Duties and authorities of the Board of Commissioners of PT Sinar Mitra Sepadan Finance according to the Articles of Association of PT Sinar Mitra Sepadan Finance, are follows:

- The Board of Commissioners during the Company's office hours shall have authority to enter the building and yard or other places used or controlled by the Company and shall have authority to examine all books, letters and other evidences, to check and reconcile the cash situation and others and shall have authority to find out all actions taken by the Board of Directors;

- When all members of the Board of Directors are temporarily dismissed and the Company does not have a single member of the Board of Directors, the Board of Commissioners is temporarily obliged to manage the Company. The Board of Commissioners shall be authorized to grant temporary powers to one or more of the members of the Board of Commissioners at the expense of the Board of Commissioners; dan

- In the event that there is only one member of the Board of Commissioners, all duties and authorities given to the President Commissioner or a member of the Board of Commissioners also apply to him.

C. Duties and authorities of Sharia Supervisory Board of PT Sinar Mitra Sepadan Finance according to the Articles of Association of PT Sinar Mitra Sepadan Finance, are follows:

- Provide advice and suggestions to the Board of Directors and supervise the Company's Sharia financing activities in accordance with Sharia Principles;

- Provide opinions on the use of certain contracts for Sharia Financing business activities;

- Supervise the development process of the Company's new Sharia financing products;

- Request a fatwa to the National Sharia Council for the Company's new Sharia financing products that do not yet have a fatwa; and

- Conduct periodic assessments on the fulfillment of Sharia Principles.

Internal Control System

SMS Finance is carrying out efforts to minimize the risks that occur by mitigating the risks of business activities in order to deal with the complexity of business activities.

Internal control efforts by SMS Finance are carried out in a preventive and repressive way. Preventive internal control is carried out by complying with applicable laws and regulations to minimize the risk of the company's business activities.

The internal control system is carried out by:

- There is a firm and clear separation of functions between operational functions including business with compliance, monitoring and internal control functions.

- Conducting periodic reviews of applicable policies.

- Implementing 3 lines of defense which 1st line is related work unit, 2nd line is Legal and Compliance Division, and Risk Management Division, and 3rd line is Internal Audit Division.

- The Legal and Compliance Division ensures that the company has complied with the policies set by the regulator.

- Conduct periodic risk assessments.

The Internal Audit Division conducts an audit of all business activities in the company, and provides policy inputs that need to be implemented as a form of improvement.

Corporate Committee

A. Audit Committee

The duties and responsibilities of the Audit Committee are set out in the Audit Committee Charter to provide independent and objective advice to the board on the adequacy of management arrangements in relation to the following aspects of the management of the organisation.

- Values and Ethics

- Corporate Governance

- Risk Management

- Fraud

- Supervision

- Compliance

Other than the 6 (six) aspects above, Audit Committee also supervises internal audit activities and external auditors.

B. Nomination and Remuneration Committee

The Nomination and Remuneration Committee is responsible to the Board of Commissioners in assisting in carrying out the duties and functions of the Board of Commissioners related to nomination and remuneration to the Board of Commissioners and the Board of Directors.

C. Risk Monitoring Committee

The Risk Monitoring Committee is responsible to the Board of Commissioners in assisting in carrying out the duties and functions of the Board of Commissioners related to the implementation of risk monitoring in the company.

D. IT Steering Committee

This committee is tasked with formulating, deciding, supervising, and evaluating the Strategic Plan of Information Technology and its implementation, as well as providing solutions to IT problems that cannot be solved at the Department or Division level.

E. Sanctions Committee

The Sanctions Committee is tasked with providing sanctions recommendations for violations of the Company's policies/regulations and/or the sanctions matrix objectively in accordance with the weight of the violation.

F. Corporate Risk Management Committee

The Corporate Risk Management is responsible for monitoring and controlling risks in accordance with applicable regulations.

G. Credit Risk Committee

The Credit Risk Committee is responsible to the Board of Directors in assisting the duties and functions of the Board of Directors related to the implementation of Risk Management in the Company.

H. Pricing Committee

The Pricing Committee is responsible for discussing and reviewing unit prices by comparing the prices on the market, the selling price of repossessed units, the quality of bookings of the unit type and certain agendas that have been determined by the members of the Pricing Committee.

I. Bussines Continuity Plan Comittee

The Bussines Continuity Plan Committee is responsible for providing response decisions to composite rating incident "Medium" dan "High".

J. Sharia Business Activity Product and Development Committee

The Sharia Product and Development Committee is responsible to the Board of Directors in assisting in carrying out the duties and functions of the Board of Directors related to the implementation of Sharia Products and Development of Sharia Business Activities in the company.

The Implementation of Anti-Money Laundering ("AML"), Counter-Terrorist Financing ("CTF"), and Counter-Proliferation Financing of Weapons of Mass Destruction ("CPF")

SMS Finance has prepared and implemented the AML, CTF and CPF policies as a form of implementing the principles of transparency, accountability, responsibility, independency, fairness.

The Board of Directors of SMS Finance assigns officials as the person in charge of implementing the AML, CTF and CPF programs ("AML, CTF and CPF Officials"). AML, CTF and CPF Officials are determined and appointed by the Board of Directors and are responsible to the President Director.

The implementation of the AML, CTF and CPF programs is carried out by:

- Reviewed policies related to AML, CTF and CPF programs in accordance with regulations issued by OJK, PPATK, and ORIX Corporation;

- Identify and verify the implementation of Customer Due Diligence/CDD for Prospective Debtors, Debtors, Third Parties (Business Partners) and Prospective Employees.

- Conduct Enhanced Due Diligence/EDD for Prospective Debtors, Debtors, Third Parties (Business Partners) And Prospective Employees in accordance with predetermined criteria;

- Postponing transactions, rejecting transactions, closing business relationships and temporarily suspending Prospective Debtors, Debtors, Third Parties (Business Partners) And Prospective Employees who do not meet the criteria and/or identified in AML, CFT and PPPSPM activities;

- Monitoring and updating data;

- Conduct risk assessments of TPPU, TPPT, and/or PPSPM related to Debtors, countries or geographical areas, products, services, transactions or delivery channels, as many as 1 (one) time in 1 (one) year;

- Administering documents;

- Reporting TKT and TKM to PPATK.

- Reporting to the Director and Board of Commissioners regarding the implementation of policies and procedures for the implementation of the AML, CTF and CPF programs.

- Periodically monitor and ensure that follow-up to DTTOT and DPPSPM complies with laws and regulations regarding the prevention and eradication of TPPT and regulations regarding the prevention of eradication of CPF.

SMS Finance has an AML & CTF system to accommodate all parties of SMS Finance to conduct CDD, both for Prospective Debtors, Employees and Business Partners.

Reporting System

SMS Finance has taken several steps to detect fraud that also involves Business Partners. SMS Finance's Business Partners also have a role as part of the fraud prevention program.

SMS Finance provides a media for external parties who become Business Partners such as showrooms, service bureaus, professional collectors, and so on to report to anti.fraud@smsfinance.co.id when SMS Finance’s employees or other parties want to commit dishonest acts, have elements of fraud or conflicts of interest in the implementation of cooperation.

PT Sinar Mitra Sepadan Finance Official Social Media Account Policy

Media Sosial SMS Finance

Latar Belakang

Media sosial memberikan kesempatan bagi PT Sinar Mitra Sepadan Finance (“SMS Finance”) dan para karyawannya untuk dapat berbagi informasi serta berkomunikasi dengan debitur dan masyarakat luas. Namun, hal ini memerlukan pengaturan yang baik untuk dapat dilakukan secara bertanggung jawab.

Dikarenakan dengan mudahnya seseorang dapat membuat akun di media sosial dan dapat mengatasnamakan orang lain, organisasi dan/atau sebuah perusahaan, maka SMS Finance menganggap penting bagi kami untuk menyatakan kepada publik akun media sosial resmi milik SMS Finance.

Akun Media Sosial Resmi

Adapun daftar akun-akun media sosial resmi milik SMS Finance adalah sebagai berikut :

Facebook : https://www.facebook.com/SMSFinanceID

Instagram : https://www.instagram.com/smsfinanceid

https://www.instagram.com/learning.smsf

Sikap Pengunaan Media Sosial

Penyangkalan

Website : https://bantuan.smsfinance.co.id

Telepon : 1500403

Email : customer.care@smsfinance.co.id